Are you aware of the fact that having dependents still has the potential to save you hundreds of dollars in tax, despite the elimination of the dependency exemption of $4,050? It is true! Below, we provide you with some expert insight into the different tax benefits that you can continue to take advantage of going forward.

Child Tax Credit

Tax credits are different from tax deductions in that they reduce your taxes dollar-for-dollar. The great news is that while the dependency exemption is no longer in existence, the Child Tax Credit has been

doubled and is now $2,000 in total. You should qualify for this credit if you are the caregiver of one or more children under the age of 17, and if you and your partner’s income threshold is $400,000 (if you are married and filing jointly). If you are single, the income threshold currently sits at $200,000.

doubled and is now $2,000 in total. You should qualify for this credit if you are the caregiver of one or more children under the age of 17, and if you and your partner’s income threshold is $400,000 (if you are married and filing jointly). If you are single, the income threshold currently sits at $200,000.

Child and Dependent Care Credit

There is no doubt that working parents will all agree that childcare takes a massive chunk out of their earnings. Luckily, many of these parents are eligible to receive the Child and Dependent Care Credit. The only criteria are that you are employed or actively in search of a job and your child(ren) and/or dependents are under the age of 13 or are disabled in some way. With this credit, you will also receive a dollar-for-dollar reduction of between 20% to 35% (depending on your annual income) of $3,000 ($1,050) for one child or $6,000 ($2,100) for two or more children.

or are disabled in some way. With this credit, you will also receive a dollar-for-dollar reduction of between 20% to 35% (depending on your annual income) of $3,000 ($1,050) for one child or $6,000 ($2,100) for two or more children.

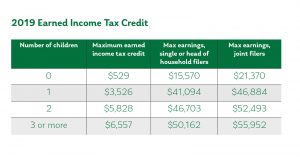

Earned Income Tax Credit (EITC)

If you earn less than a certain amount and you have children in your care, you may qualify to receive the Earned Income Tax Credit. For the tax year 2019, the credit ranges from $6,557 for three or more children down to $529 with no children.

Would you like more information regarding tax benefits in the USA? Then it is time to book an appointment with the Certified Public Accountants at Georgen Scarborough Associates, PC. Contact us today!