Each tax credit program has its own eligibility criteria, so it’s crucial to review these requirements carefully. Common eligibility factors include:

- Type of property (primary residence or second home)

- Installation dates (some credits may require installations to be completed by a specific deadline)

- Manufacturer certifications and product specifications

- Maximum credit amounts

Ensure that you meet all the specific criteria for the tax credits you intend to claim.

Keep Detailed Documentation:

Accurate documentation is essential when applying for home energy tax credits. Keep thorough records of all relevant documents, such as:

- Invoices and receipts for product purchases and installation costs

- Manufacturer certifications and product specifications

- Proof of ENERGY STAR ratings or other energy efficiency qualifications

- Photos or documentation of the completed upgrades

Having these records on hand will simplify the tax credit application process.

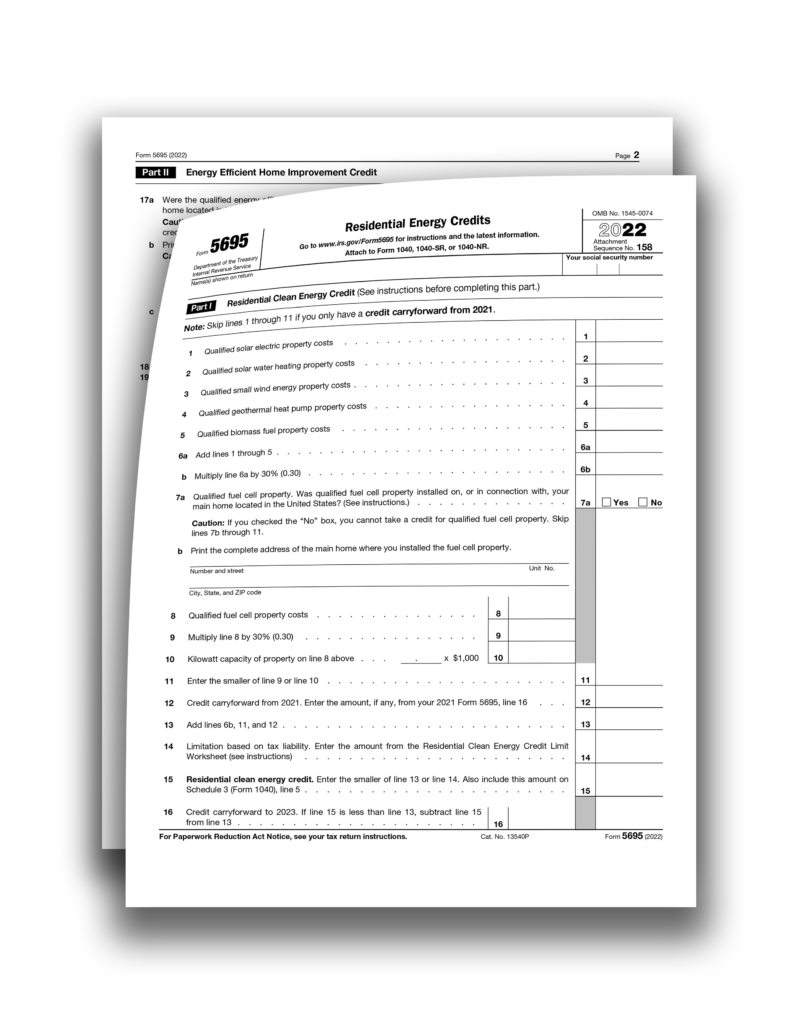

File the Appropriate Tax Forms:

To claim home energy tax credits, you will need to file the necessary tax forms. Typically, you will use IRS Form 5695, Residential Energy Credits, to report your eligible expenses. Be sure to follow the instructions provided with the form and include all required documentation.

Consult with Georgen Scarborough Associates:

Navigating the tax code can be complex, especially when claiming energy-related tax credits. Consulting with Georgen Scarborough Associates who specializes in helping homeowners maximize their tax credits, can help ensure that you follow all the rules and regulations and maximize your tax savings.

Submit Your Tax Return:

Include your completed IRS Form 5695 and all supporting documents when you file your annual tax return. It’s essential to submit your tax return accurately and on time to receive the energy tax credits you’re eligible for.

Conclusion:

Receiving home energy tax credits is a rewarding way to offset the costs of energy-efficient home improvements while contributing to a more sustainable future. By identifying eligible upgrades, researching available tax credits, meeting eligibility requirements, maintaining detailed documentation, and seeking professional guidance when needed, you can successfully navigate the process and enjoy the financial benefits of a greener, more energy-efficient home.

For more information on how to receive credit for your home improvements for 2023 – 2032’s Home Energy Tax Credits, contact Georgen Scarborough Associates at (703) 319-3990 or through their website at gsacpa.com.

Source: Energy.gov, IRS.gov

Visit the Energy.gov site for more information:

Making Our Homes More Efficient: Clean Energy Tax Credits for Consumers | Department of Energy

Visit the IRS.gov site for more information:

Home Energy Tax Credits | Internal Revenue Service (irs.gov)

Energy Efficient Home Improvement Credit | Internal Revenue Service (irs.gov)